Making art market investments could be a gratifying and thrilling experience. Like any other investment, it requires careful consideration and research to ensure a successful outcome.

This section will provide an overview of the necessary steps for investing in art with confidence. The first step is to establish clear objectives and guidelines for your investment journey. This entails identifying what you desire to accomplish through your art investments, whether it’s long-term appreciation, diversification of your portfolio, hedging against inflation, or simply a passion for collecting. By defining your goals, you can make well-informed decisions that align with your financial aspirations. Conducting thorough research is also crucial. Speaking with experts in the field can provide valuable insights into potential investment opportunities. This involves talking to art galleries, auction houses, art fairs, and online platforms to obtain information on current trends and market conditions. Having these conversations will help you determine what type of art you want to invest in & chalk out the best path forward.

When considering which type of art to invest in, assess your personal preferences, risk tolerance, and financial goals. Each category offers its advantages and considerations that should be carefully evaluated before making any investment decision. In this section, we will explore three distinct categories of art for investment: Old Masters, Blue Chip Art, and Emerging Artists.

Old Masters

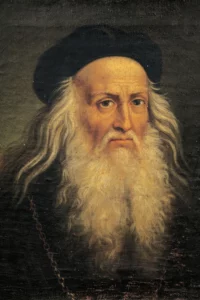

Old Masters refer to renowned artists from the past whose works have stood the test of time. These artworks hold historical significance and are often highly sought after by collectors and museums. Investing in Old Masters can provide a sense of cultural heritage and offer potential financial gains as their value tends to appreciate over time. A few examples of Old Master Paintings are Salvator Mundi by Leonardo Da Vinci, Libyan Sibyl by Michelangelo & The Jewish Bride by Rembrandt.

Blue Chip Art

Blue Chip Art represents established contemporary artists whose works have achieved significant recognition within the art world. These artists have a proven track record of success, with their pieces being exhibited in prestigious galleries and museums worldwide. Investing in Blue Chip Art offers stability and credibility as these artworks are considered safe bets within the art market. A few examples of Blue Chip Artists are Andy Warhol, Pablo Picasso & Keith Haring.

Emerging Artists

On the other hand, investing in Emerging Artists can be an exciting opportunity for those seeking to support up-and-coming talent while potentially reaping substantial returns on investment. Emerging Artists are often characterized by their fresh perspectives, innovative techniques, and unique artistic voices. As they gain recognition and popularity, their artworks can significantly increase in value.

Conclusion

Finally, understanding the different investment vehicles in the art industry is crucial. From purchasing individual artworks to investing in funds or shares of art-related companies, there are numerous ways to participate in this market. By familiarizing yourself with these options and assessing which ones align best with your goals and risk tolerance, you can make informed decisions. If you decide to purchase an entire piece of artwork, it’s advisable to have it appraised by a professional appraiser. This step ensures that you have an accurate understanding of its value before making any financial commitments.

By following these guidelines and taking a proactive approach to researching and evaluating potential investments, you can navigate the art market confidently and make informed decisions that align with your financial goals.