In April 2022, I stumbled across a Reddit post that really scared me.

In it, the author described how housing prices had been pushed to all-time highs by hedge funds and foreign buyers using borrowed money. Those buyers had put up various stocks and bonds as collateral, but the value of those assets was collapsing. Chinese real estate behemoths like Evergrande were defaulting on their debts, the stock market was wobbly, and many of the companies holding property were exposed to the losses. If things didn’t turn around, many of them would get “margin called,” meaning they would either need to post additional collateral (which they didn’t have), or quickly sell the properties they owned.

The combination of these investors dumping property, rapid rate hikes by the Fed, and home prices hitting a 70-year-high caused the author to believe that we were in for the mother of all real estate crashes, which would begin shortly.

Six months prior to reading this post, my wife and I had just purchased our first home. At the time we felt lucky; we were able to get a mortgage before the spike in interest rates, and our home’s value had increased relative to the purchase price.

But the post made me think that maybe we should consider selling. Our down payment on the house wasn’t very large, and we planned to move within 5 years, either for my wife to attend graduate school or for me to take a job elsewhere. Interest rates were already climbing, and if we waited to sell I worried we could be underwater on our mortgage for many years to come, preventing us from moving if we needed to.

It’s now a year and a half later and our home’s price has only declined slightly from its all-time-high. We are still above water on our mortgage. Our home is still worth more than when we bought it in November of 2021. So thankfully my fears have thus far been unfounded. But why? What was I missing that had so misled me in 2022?

In this article, I’m going to tell you why home prices haven’t crashed despite appearing to be less affordable than ever, and why, with a few notable exceptions, it’s so hard to go wrong buying an investment property.

Hybrid remote work has driven up demand for property in the post-pandemic era

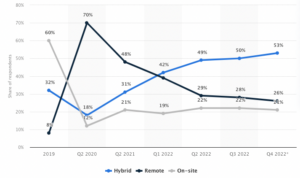

During the COVID pandemic of 2020 and 2021, the number of people working remotely in the United States went from 8% to a peak of 70% at the height of the pandemic.

It has since declined to 26% as of Q4 2022 (still triple the pre-pandemic rate!), but most workers that have returned to the office are now working in a hybrid setup with days at the office and days working from home.

This in turn has increased demand for property as people have either opted to move into a larger house, buy a second home outside the city, or move out of their previous living arrangement into a larger property to make room for a home office.

More than three years out from the COVID pandemic, this shift to hybrid and remote work looks to be permanent. This key piece of information was missing from the Reddit post about the “2022 real estate collapse.”

There’s not enough housing where people want to live

Source: Reddit user u/Squaliebawse

One of the charts I saw in the scary Reddit post from April of 2022 was this chart showing the ratio of home price to median income over time:

This chart LOOKS LIKE a very good representation of the affordability of housing; after all, if your house is 7x your annual income, it’s going to be a lot harder to pay off than if it was only 3x your annual income, right?

But there’s a key flaw with the chart above which I didn’t realize at the time: it doesn’t take interest rates into account. Here’s a chart showing the fed funds rate over the last 50 years:

You can see an intermittent but slow decline in interest rates since the days of Paul Volker in 1980 when interest rates peaked at around 20%. This decline in interest rates has helped offset the run-up in home prices since that era.

In 1980, with average mortgage rates at a whopping 18%, a mortgage payment for the median home would consume a whopping 68% of household income. Today, even with mortgage rates having risen dramatically from 3% to 7% and home prices at an all time high, payments would only consume 56% of household income. Mortgage rates would have to rise another 2.5% for housing to become as unaffordable as it was in 1980.

Still, 1980 was not exactly the peak of real estate prices, so in the absence of other factors we would expect a considerable drawdown in prices. But there is one last factor buoying house prices: there is simply not enough housing in the places people want to live.

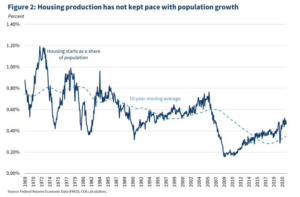

Following the financial crisis of 2008, construction of new housing fell off a cliff, and remained severely depressed for seven years. This was yet another key piece of information missing from the Reddit post I mentioned earlier.

The number of new housing units built per American has been on a slow decline since the 1960s, and fell to near zero following the financial crisis. They have remained extremely low ever since, and still haven’t recovered to their pre-crash highs as of 2021.

This constraint on supply is the final missing puzzle piece. There is simply not enough new housing, so people compete ever more fiercely for existing property, particularly in large coastal cities where economic growth has been concentrated over the last decade. This is also not a problem the market can simply correct for, as most cities where new jobs are created severely restrict the construction of new housing with restrictive zoning laws, mandatory multi-year environmental review processes, community input that can delay the start of construction, and a dizzying array of rules and regulations which add significantly to the cost of new construction.

So though it’s still possible property prices will decline from their late 2022 highs, I would be very surprised if we see another crash like the one we saw in 2008. Property will continue to be an appealing asset, and maybe particularly so in the coming years due to one special characteristic it shares with precious metals.

Land is an inflation-proof asset in a high inflation era

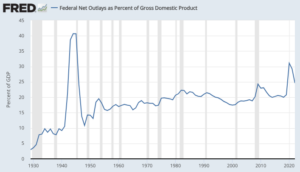

Since the New Deal began in the 1930s, federal government spending has seen a slow but steady increase as a share of national GDP.

For political convenience, and because of low interest rates, a significant portion of recent expenditures has been financed by the federal government taking on more and more debt. This makes voters happier in the short run, but brings significant long-term risk, particularly when interest rates must rise to combat inflation, as they have done over the last few years.

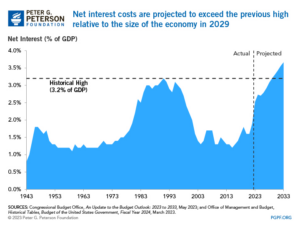

Interest payments on US treasuries have recently increased from near zero to 5.5%. This has led to a sharp spike in net interest payments as a percentage of gross GDP. We may see the highest government expenditures on debt service in the last hundred years over the coming decade.

There are two ways to lower the burden of government debt: one is to raise taxes and cut government spending. This has proved politically unpalatable in the United States over the past several decades, and likely will remain so over the coming years.

The second option is to print money, which causes inflation and lowers the cost of servicing debt. This option also has significant downsides — savings become less valuable and purchasing power shrinks. It has nonetheless tempted many governments throughout history because it preserves government spending power while lowering their debt burden.

In the United States, this would be done by a mechanism called quantitative easing. Quantitative easing is a mechanism that can be used by the federal reserve to control the money supply. Here’s how it works:

What is quantitative easing and where did it come from?

Quantitative easing is when the federal reserve prints money and uses it to buy assets.

It was first introduced in the 2008 financial crisis as a means to stabilize the economy. At the time, it was implemented in order to stabilize banks following the collapse of Lehman Brothers and concerns that, without intervention, the entire US banking system could fail. During the crisis (and indeed for a long time afterwards, the Federal Reserve printed money and used it to buy up troubled assets like mortgage backed securities, CDOs, corporate bonds, and federal treasuries.

It was also used extensively during the COVID pandemic to bolster the economy more generally.

If the Federal Reserve feels compelled to buy up large quantities of US debt in order to prevent a government default or a serious economic downturn, it will cause high levels of inflation just as it did in 2021 and 2022. In such an environment, property ownership is a very strong hedge against inflation. The government can always print more dollars, but with very rare exceptions, it can’t create any more land.

Ten thousand years of urbanization

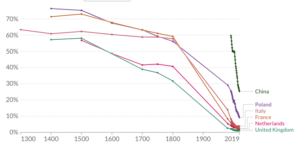

Humans have been steadily moving to cities for hundreds of years. But the trend really accelerated when the industrial revolution kicked in and the percentage of people working in agriculture dropped precipitously.

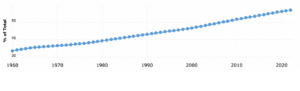

When people don’t need to work in the fields, they usually move into cities to find employment. You can see this reflected in graphs like the one below, which show the percentage of people living in urban areas over time.

This trend is continuing even in developed countries, though there has been a recent downtick with people leaving cities following the COVID pandemic.

But the long term trend is clear: the average person lives in a much denser living environment than they did 100 years ago, and that trend is likely to continue. Buying an investment property in places where density is increasing is almost always a good idea.

Don’t try to time the market when buying an investment property

All of this brings me to my main point: property prices may rise or fall in the short term, but in the long run buying an investment property is one of the most stable long term decisions you can make. It’s possible that property prices will decline somewhat in the next year or two, but far from certain. And given the increased demand for property due to remote work and the chronic lack of housing supply, it’s possible property prices could increase even further. In either case, it’s very unlikely that property prices will be lower a decade from now.

In the meantime, buying an investment property can either provide a wonderful place for you to live or a stable cash-generating asset should you choose to rent it out. If you find a property you like and decide to take the plunge, get in contact with us and we can help you save a little bit of money and get into a property faster.