Property prices have fallen from their peak in late 2022 but are still fairly high on a historical basis. Interest rates have risen substantially since their low in mid-2020, but many expect them to come down in the next couple of years. Some of our employees and customers have been asking us whether they should buy a house or investment property now and refinance in a couple of years or wait until interest rates drop to snag something appealing. This article will address under what circumstances you should buy now and what circumstances you should wait.

As of my writing in late August 2023, average mortgage rates in the US are 7.2%, the highest level since 2001. Most forecasts project that interest rates will drop a few percent over the coming years, though analysts are uncertain about the exact timing.

Mortgage rate forecasts are all over the place, and there’s not a lot of good public data about futures for mortgage rates, so I’m going to look at the Fed funds rate instead and try to extrapolate mortgage rates based on that.

The Fed funds rate is the interest rate banks charge one another when lending each other money. The Federal Reserve manipulates the Fed funds rate by purchasing and selling assets like treasuries and bonds.

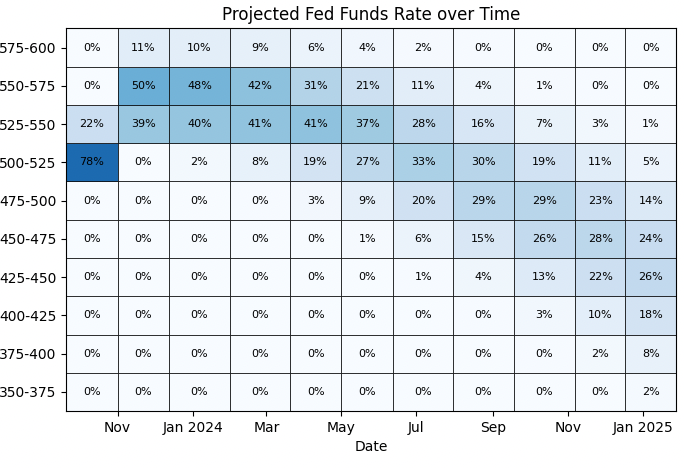

Here’s a graph showing what the futures markets believe the Fed funds rate will be over the next year and a half:

We can see that the market believes rates will rise another 25 to 50 basis points and then start to decline some time around April of next year. The market expects a roughly 100 basis point drop over the course of next year, though you can see there’s a reasonably wide uncertainty interval.

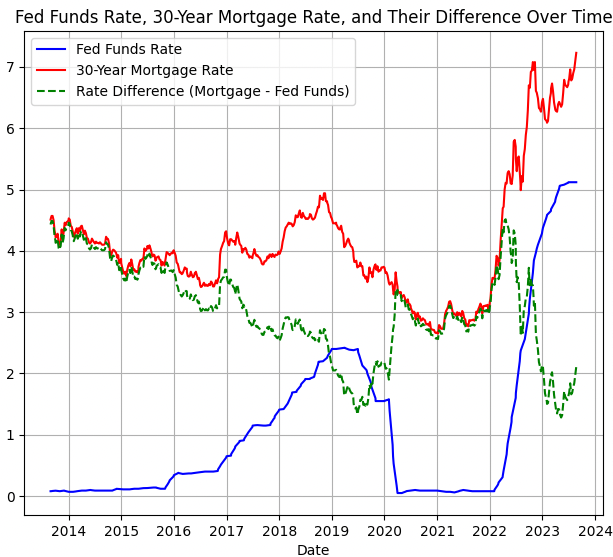

But how would that affect mortgage rates? To see, let’s take a look at how the Fed funds rate and mortgage rates have been related over the past decade or so:

Fed funds data source

30-year fixed mortgage rate data source

The two are pretty clearly correlated. And that’s not surprising — banks are generally perceived as more creditworthy than homeowners, so a bank will only lend out money to a homebuyer if they can get a higher interest rate on it than what they would get for lending to another bank. So we would expect mortgage rates to rise whenever the Fed funds rate does. Correspondingly, we would expect it to fall whenever the Fed funds rate falls.

However, the two are not perfectly correlated. You can see in the graph above that the spread (represented by the green line) changes over time. When the Fed raises interest rates, the spread shrinks. And when they lower rates, the spread tends to increase.

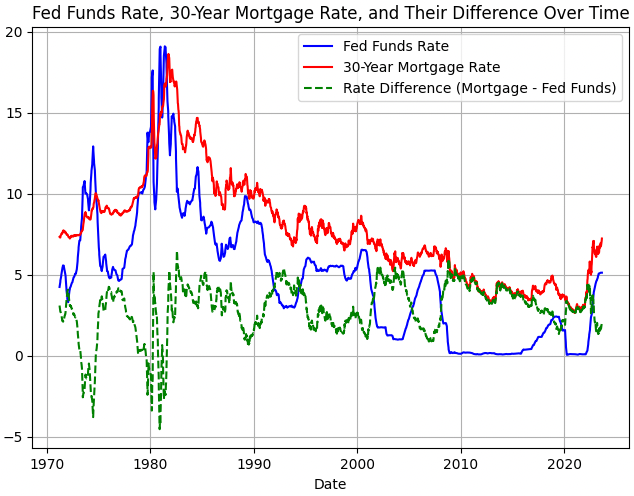

This pattern is borne out over a longer time period. Here’s the same graph as above but zoomed out to show rates over the last 50 years:

Fed funds data source

30-year fixed mortgage data source

In the post 1980s world, the spread has always seemed to hover between about 1 and 6%.

The difference between mortgage rates and the Fed funds rate is already near its lowest levels in the post-1980s era: around 1-2%. So it seems unlikely that we will see large decreases in mortgage rates in the next year and a half.

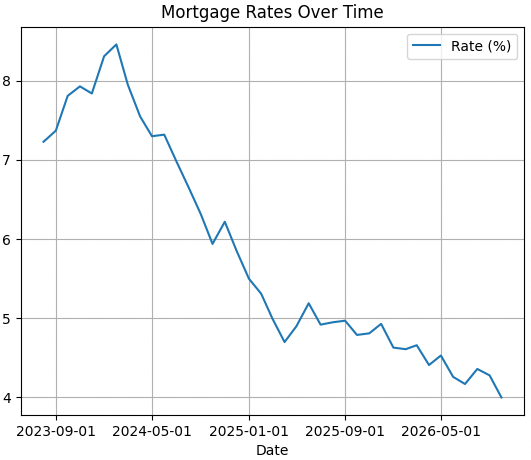

Over a longer time horizon though, it does seem likely that mortgage rates will drop by a few points. Here’s a forecast of mortgage rates from The Economy Forecast Agency:

Are these projections realistic? My best guess is they are optimistic about the rate of decline. The markets think we’ll see about a 0.75% interest rate drop by early 2025, and this chart projects a decline of almost 2%. I’d expect something closer to a 0.25-0.5% drop by then, and further drops later.

So should you buy now and refinance later?

The short answer is yes, you probably should.

Given how property prices are already at historical highs and the fact that interest rates are still relatively high, property prices seem unlikely to increase much more over the next couple of years. They’ve come down from their peak at the end of 2022, and may come down a bit more, but seem very unlikely to crash from their current levels.

Most projections show that mortgage rates are likely to continue increasing for the next 6 months or so before they will begin declining. So if you’re going to wait, you’ll likely have to wait at least a year before rates are any cheaper than they are right now.

However, if you buy now, you don’t need mortgage rates to drop very much for a refinance.

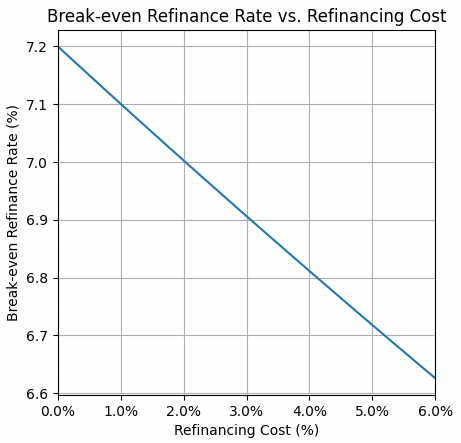

Let’s lay out a scenario: suppose you purchase a property for some amount of money (it doesn’t really matter how much). Let’s also suppose you get the median rate on the mortgage: 7.2% as of September 2023. If you want to refinance later, how much would interest rates have to drop for refinancing to save you money after accounting for the costs?

Refinancing generally costs between 2 and 6% of the loan amount. Here’s a chart showing how much interest rates would need to drop for your new mortgage payment to be less than your old one.

If you’re able to secure a cheap refinancing package, you’ll be in the green if interest rates drop at least any more than 0.2% from their current rates! Even if you get a very expensive refinancing package, you’d still only need rates to drop by about 0.6%.

Markets think the Fed funds rate will drop by about .6% by the end of next year (and likely more after that). Mortgage rates will likely drop as well, though the charts above show that usually happens slower than drops in the Fed funds rates. Still, 0.2-0.6% is not a very large drop. So, barring something really unexpected that substantially increases inflation, mortgage rates will almost certainly drop enough to cover the cost of refinancing by sometime in 2025.

If you need help picking out or buying a property, get in touch! You can email us at [email protected] or tweet at us.